May 29, 2018

Steven Erlanger, The New York Times

LISBON — Through more than two months of tough negotiations to form a government in Italy after inconclusive March elections, global financial markets remained relatively calm. Italy’s uncertainties seemed contained to Italy, and Europe’s economy kept growing.

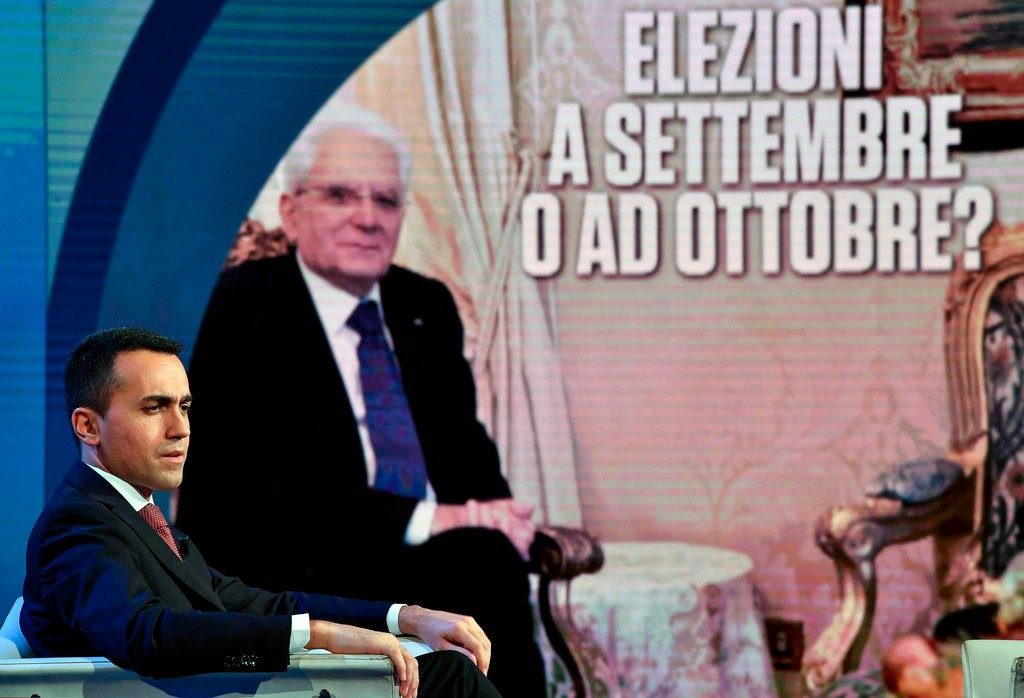

That changed this week when Italy’s president, Sergio Mattarella, effectively blocked two populist parties from forming a government. He judged that a crucial member of their proposed cabinet was intent on having Italy abandon the euro, though they had not explicitly campaigned on that issue.

In doing so, Mr. Mattarella may have laid the groundwork for a new election, one that amounts to a referendum on the euro. The European Union and financial markets reacted with dread. On Tuesday, the Dow plunged almost 400 points, the value of the euro plummeted and the cost of borrowing for Italy shot up.

For the European Union, another Italian election would be terrifically bad timing.

Chancellor Angela Merkel of Germany, a linchpin of the bloc, is weakened; she needed six months to form a government after a rough election of her own last year that was marked by a far-right, populist surge. Spain’s government could face a no-confidence vote as early as this week and possible new elections as well.

However unlikely an Italian withdrawal from the eurozone may be, the mere prospect is more dangerous to the future of the European Union than the bailout of Greece, whose economy is dwarfed by Italy’s; Britain’s vote to leave the bloc; or the squabbles over the rule of law with Hungary and Poland.

Italy is a founding member of both the European Union and the euro and the bloc’s fourth-largest economy, and psychology counts.

After all, it was Brussels that warned Greece in 2011 that a proposed referendum on its bailout and the euro would actually be a referendum on membership in the European Union itself. That was enough to cause Greece to back down. It did so again four years later.

But the common currency is not without its problems. The European Union plunged into the euro without having either the economic institutions to fully manage it or full political integration. Member states gave up their authority over monetary policy, often to deleterious effect at home.

Today, not only will the issue of sovereignty not go away, it keeps roaring back with a vengeance, just when populism in Europe’s core countries seemed to have been kept at bay.

After the shock of Britain’s vote in 2016 to leave the European Union, the bloc seemed unexpectedly steady. Italy had a pro-Europe government for several years. Spain and Portugal were growing again. France’s anti-Europe presidential candidate, Marine Le Pen, was defeated. Even the populist Prime Minister Alexis Tsipras in Greece was grudgingly holding the line on spending in order to stay in the eurozone.

But the turmoil in Italy makes clear that anti-European populism has not gone away, and that the euro is in the cross hairs.

Mr. Mattarella has turned to a former International Monetary Fund official to be a caretaker prime minister and form a government. But even he seemed to have hit a wall late Tuesday evening, making the prospect of another election — as early as July or September — more likely.

Matteo Salvini, the fiery leader of the League, the populist party that is strong in Italy’s north, has made opposition to Brussels, and occasionally the euro, a standard in his campaign speeches.

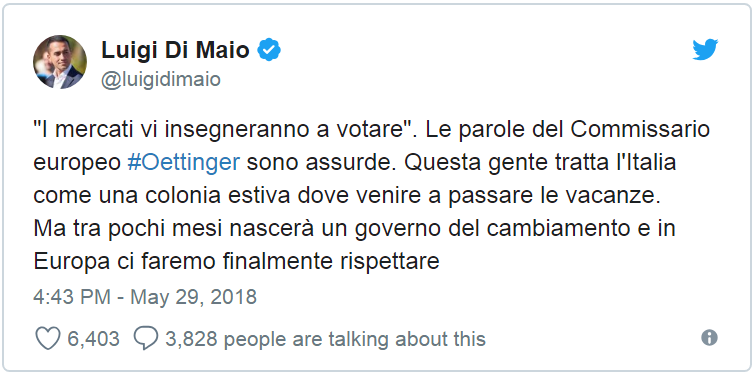

His putative coalition partner, Luigi Di Maio, leader of the populist Five Star Movement, has been sharply critical of Brussels, but has lately rejected a referendum on the euro, despite having previously floated the idea.

Mr. Mattarella, moderate and pro-Europe, was clearly skeptical of their intentions, and he vetoed Mr. Salvini’s pick of an economy minister with openly anti-euro views, in the name of economic stability.

In doing so, Mr. Mattarella has given Italians, exceptionally, the same option built into the French election system — two rounds of voting — the first to vote your heart, and the second to vote your head. In France, Ms. Le Pen did well in the first round of presidential voting last year; she was soundly defeated in the final round.

Mr. Mattarella is gambling that Italians may do the same, if the populist parties can be made to surrender their ambiguity on the euro — an issue they skirted through the Italian campaign.

As of November, a poll by the European Commission, the bloc’s bureaucracy, showed that nearly 59 percent of Italians preferred European economic and monetary union with a single currency, the euro, while 30 percent were opposed.

The risks of leaving the euro have always been a reason Italy has stayed in. But the country has not done well with the euro, by some measures, and so the question now is whether a public frustrated by two decades of stagnation is ready to take a gamble of its own and bolt.

As demonstrated by the Brexit vote, which numerous analyses showed would not be good for Britain’s health, economic logic does not always prevail.

Like Ms. Le Pen, Mr. Salvini may discover after a public debate that despite anger at Brussels over migration and the problems of the euro, Italians, like the French and the Greeks, are afraid to leave it.

But Mr. Salvini has also proved himself adept at playing populist passions and has again made opposition to the euro and its “elite” supporters central to his politics.

Many analysts believe that Mr. Salvini, whose League has risen in the polls, will do well in a future election, and some think he sabotaged this coalition government to get to new elections.

He is expected to use Mr. Mattarella’s attempted appointment of a technocratic — if temporary — prime minister to reinforce the League’s anti-elitist message and portray himself as standing up against anti-democratic forces beholden to Brussels, Berlin and the bankers.

The euro may have originally been a project of the political elite, and it may indeed benefit Germany, but the consequences of leaving it would be big. Those would be likely to include a devalued Italian currency that would savage Italian savings accounts overnight and increase the country’s already large burden of debt.

That is one reason Mr. Mattarella argued that any decision to leave the euro should come only after a major public debate, not by stealth.

Then there is the potential damage to the European Union itself. The bloc has moved since the Greek crisis to create backstops for the euro, so the currency would almost surely survive an Italian exit and manage the economic contagion. But the damage to the idea of Europe would be severe.

Italy’s confusion about its political and economic future — and its already large stock of nonperforming loans — are more reasons Germany will continue to refuse to mutualize eurozone debt and provide bank deposit guarantees across the eurozone.

As Holger Schmieding, chief economist of Berenberg, an investment bank, points out, “Size matters.” Italy today accounts for 15.4 percent of the eurozone’s gross domestic product and 23.4 percent of the bloc’s public debt.

By comparison, he said, at the start of the Greek crisis in 2009, Greece contributed only 2.6 percent of the eurozone’s gross domestic product and today accounts for only 3.3 percent of eurozone public debt.

Italy’s cumulative debt is more than 130 percent of gross domestic product, more than twice the eurozone’s requirements, and it is denominated in euros. Having to repay that debt in a devalued currency would be a major struggle and would badly harm Italian savers and investors, who hold most of it.

The Italian crisis also has other implications, said Ian Lesser, vice president for foreign policy at the German Marshall Fund and head of its Brussels office.

“The political debate in Italy has taken on an increasingly critical tone toward Germany, speaking directly to Italian anxiety over German power in Europe,” Mr. Lesser noted. That anxiety is shared widely, not just in Greece but in other populist-run states like Hungary and Poland.

And a prospective populist government “is not only deeply anti-E.U. but with a lot of sympathy toward Russia and without traditional Atlanticist instincts,” Mr. Lesser said.

Italy is a key member of NATO and has important naval and air bases for Middle East operations. “It threatens key elements of continuity in Italian politics, in both the European and trans-Atlantic sphere,” Mr. Lesser said.

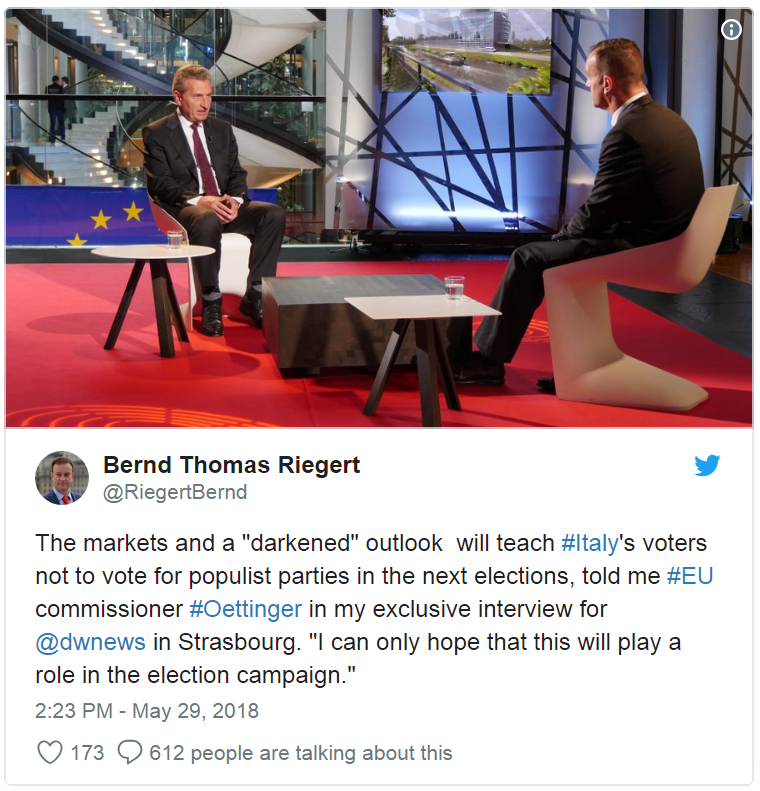

European Union arrogance could also play an important political role.

On Tuesday, the European Commissioner for the budget, Günther H. Oettinger, a German, told the broadcaster Deutsche Welle that the markets and a “darkened outlook” would teach the Italians to vote for the right thing.

They may yet do so, but it’s impolitic to say so, especially for a Brussels-based German.